In this post, I take a very brief look at the plight of the Naira since May 2023. I will focus on comparing the official rate to the rate in the parallel market using a graph I drew this evening.

One of the first executive actions that the president took was to remove subsidy from the Naira. He gave a speech on the 29th of May and the speech has had significant ramification for the nation. I am not even sure the president understood his speech on that day was an “act”, and that by uttering those statements as a president, he was triggering a series of actions that would be so consequential.

And to be honest, those statements were not very controversial. The top three candidates in the February 2023 election last year agreed on two things: removal of subsidies on oil and the Naira. This was because the three candidates are right wing in their economic ideology. However, it was President Tinubu who had the pleasure of announcing these actions and currently has the headache of dealing with the consequences.

It is time to introduce the graph:

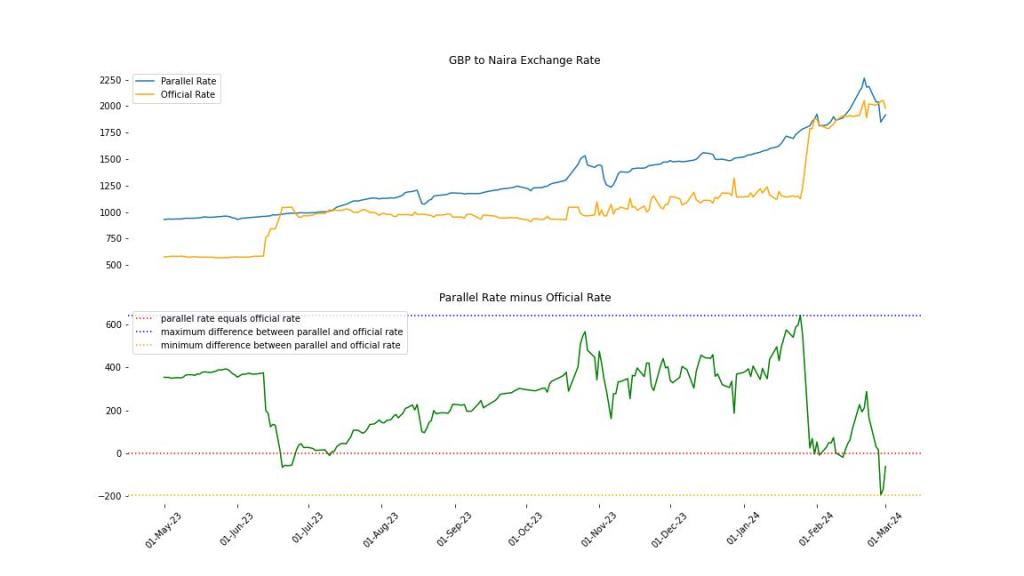

The chart at the top plots the parallel and official exchange rate of the British Pound to the Naira between 1 May 2023 and 1 March 2024. The one at the bottom plots the difference between them. They are both complementary.

First observation, is from the bottom chart. It shows that between 1 May 2023 and 12 June 2023 the average difference was around 400 naira. In the parallel market, the naira averaged less than 1000 Naira to the pound during the same period. In the official market, it averaged less than 600 Naira. Nigeria was subsidising the official rate to the tune of the difference, 400 Naira roughly.

A natural expectation was that once the President’s action began to bite, the Naira will crash in the official market and should make the parallel market less attractive. That was what happened intially. Between 13th of June 2023 and 19th of July 2023, the gap between the official rate and the parallel rate narrowed. In the bottom graph, you can see the green curve dropping until it momentarily crossed 0 (highlighted in red) on the 10th of July, 2023. From the top chart, you can see that the Naira was still devaluing during this period, but the policy was working: arbitrage opportunity between the parallel market and official market was barely there.

Unfortunately, that was as good as it got so far. From 13th of July, the difference between the parallel market and official market widened until it reached a point where the spread between the parallel market and the official market became higher than under subsidy! On 25th of January 2024, you were able to fetch extra 600 naira for a pound in the parallel market, compared to the official market. This was worse than under the subsidy regime.

The only positive thing I can see is that recently the difference has narrowed significantly, to the point where on the last day of February 2024, the official rates offered more Naira for a pound than the paralle market, as much as 200 naira (the orange line in the bottom graph).

What does the future hold for the Naira? I don’t know. If the correction we are seeing is because the government is pumping more dollar into the market, this improvement may not last. However, if it is because the government has finally found a strategic solution, maybe it will last.

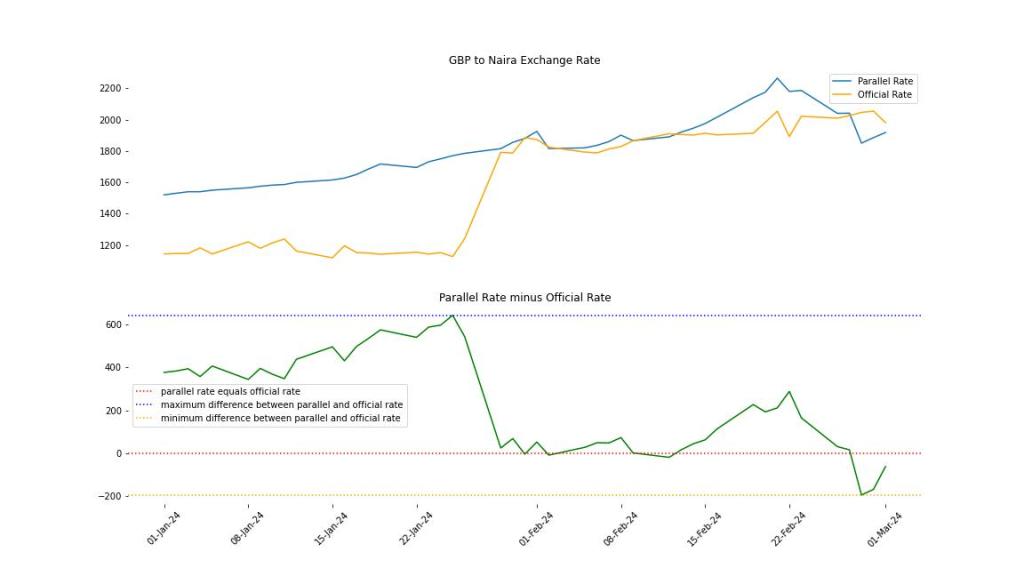

I show the same graph but just for 2024:

This year alone, the naira has swung from 1118 to 2054 in the official market, a spread of 936 Naira. You can see this in the chart at the top (the yellow curve). In fact, the parallel market has been more stable, with maximum of 2265 and a minimum of 1520, aspread of 745 naira. Not really sure how to make sense of this.

This is something that lies squarely in the court of the president and the CBN. Had it been that naira crashed in June last year to around what it is now and had remained stable since then, one could have concluded that the gap reflected the cost of subsidising the Naira when we ran two different markets as a policy under Buhari. The fact that we continue to see these devaluation periodically suggests the administration needs to get a handle on whatever is wrong.

Tactical solutions will not be enough, there is a need for strategic understanding of the problem so that a lasting solution can be found. Nigeria needs to consume as much dollar as it generates and not a cent more. The central bank needs to get a grip on the inflow of forex into the country. I always wonder whether CBN has any control on the thousands or even millions of dollars that are transacted in the Diaspora daily via self styled one man/one woman Bureau De Change.